IRS Notice CP11A

Know your obligations and protections under the law. San Diego Tax Attorney William D. Hartsock offers this advice.

Why did I receive a CP11A Notice from the IRS?

If you have received a CP11A Notice from the IRS, it usually means that the IRS believes there was a miscalculation on your tax return involving the Earned Income Credit you claimed on your return, that the IRS has made what it considers to be necessary corrections to your tax return, and that as a result of those changes, you now owe money to the IRS. If any interest and/or penalties have accrued since the date your return was due based on the IRS’s revisions to your return, they will set forth in the CP11A notice along with an explanation of how they were calculated. This could affect any Income Tax Audits & Appeals that you are involved in, as well as IRS Tax Litigation or Tax Collections actions.

Whenever you receive a CP11A Notice, you should:

- Read the CP11A Notice carefully, especially: (1) the part that explains why the IRS believes there was a miscalculation on your tax return involving the EIC, what changes the IRS has made to your return, and why the IRS believes you now owe money on your taxes; and (2) the part suggesting any additional steps you need to take.

- If you agree with the IRS’s explanation and the corrections it has made to your tax return, (1) make these corrections on the copy of your tax return that you kept, and (2) pay the full amount owed by the date indicated on the payment coupon that is part of, or included with, the CP11A Notice you received.

- If you agree with the IRS’s explanation and the corrections it has made to your return, but you are not able to pay the full amount of tax that you owe, (1) make the corrections on the copy of your tax return that you retained and (2) contact the IRS about setting up a payment plan. Be aware that interest and penalties will be assessed if you do not pay the full amount by the date on the payment coupon included with the CP11A Notice you received.

- If you do NOT agree with the IRS’s explanation and/or the corrections it has made to your tax return, and/or with the amount of interest or penalties the IRS has assessed against you, contact a Tax Attorney such as the ones at www.TaxLawFirm.net to discuss the best strategy for resolving the discrepancy with the IRS. Be sure to contact a tax law professional right away, because the IRS must generally be advised in writing about a discrepancy within 60 days of the date on the CP11A Notice you received. If the discrepancy is not addressed properly, your tax return could be referred for audit.

Answers to Frequently Asked Questions:

Why is the IRS reviewing my return?

While most returns are accepted by the IRS as filed, a certain number of returns are selected for examination. The IRS examines some income tax returns to verify that the income, expenses, and credits reported on the return are accurate. The IRS selects tax returns for examination using various methods including random sampling, computerized screening, and comparing information the IRS has received that relates to the return, such as W-2 and 1099 forms. Just because your tax return was selected for examination does necessarily mean that the IRS believes you made an error or were dishonest on your return.

If I am not able to pay the full amount of tax I owe by the due date, will the amount of my tax obligation increase?

Interest will accrue on an unpaid tax balance beginning on the day after the tax is due. Also, you will be assessed a late payment penalty if the full amount of tax you owe is not paid on the day it is due. With respect to both interest and penalties, the due date is the last date on which you could file the tax return that is at issue, including extension requests.

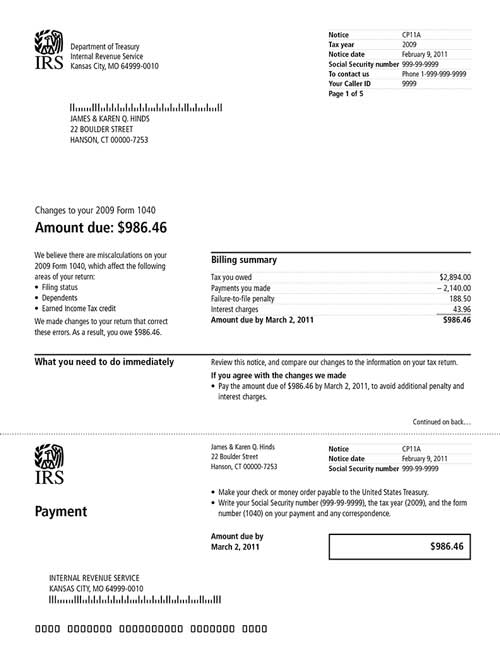

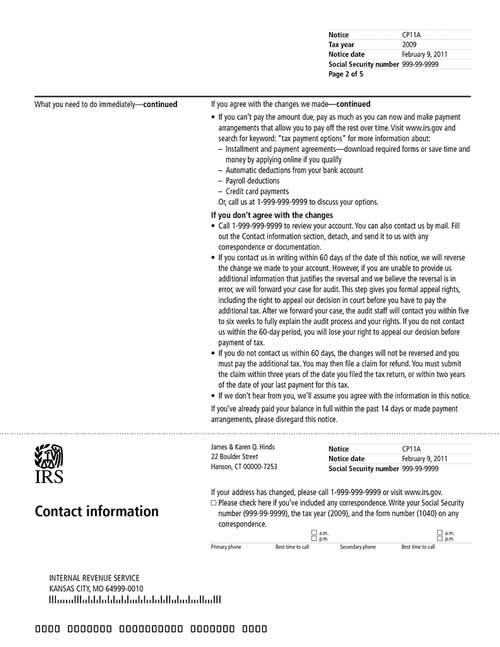

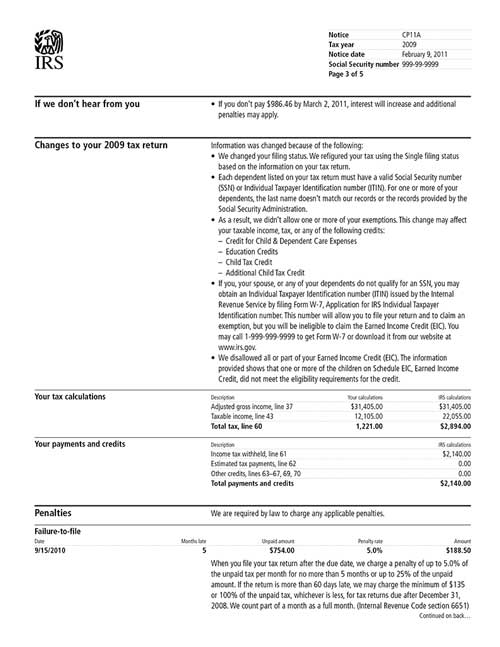

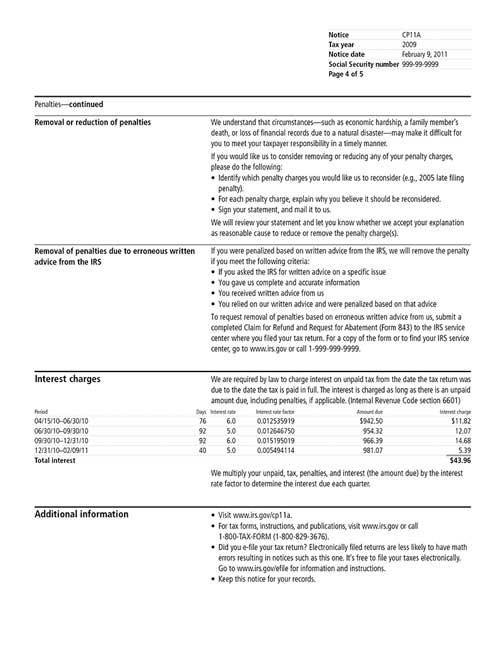

The following images are an example of what an IRS Tax Notice CP11A actually looks like.

This sample notice is for example purposes only. The case facts and figures on your notice will vary according to the specifics of your case.

Comments (0)